Some states have been stepping up their efforts to bring financial literacy to schools. Here’s a roundup of some recent state actions:

• Starting in May, Oklahoma students will have to demonstrate understanding of credit card debt, savings, retirement planning, bankruptcy, taxes, and identify fraud, among other financial literacy concepts, in order to graduate. The state passed the bill with this requirement in 2007. Slate writer Matthew Iglesias is calling these “the toughest financial literacy requirements for high-school students that have ever been attempted in the United States.”

• A Utah state Senate committee recently voted unanimously to put $500,000 toward training teachers to teach budgeting and basic economics, which students have been required to take since 2009.

• Wisconsin has allocated $250,000 toward a statewide grant program to encourage K-12 schools to teach personal finance education, reports the Wisconsin State Journal. Teachers can apply for grants of up to $10,000 to help them bring financial literacy programs to their schools.

• A Fla. senate committee is considering a bill that would make a half-credit course in personal finance education a requirement for high school graduation.

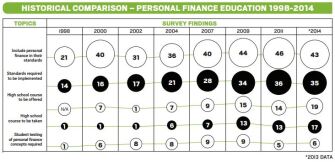

According to a recent report by the Council for Economic Education, 43 states now have K-12 standards that include personal finance education. That’s down from 46 states in 2011. Nineteen states now require high schools to offer a personal finance course, up from 14 in 2011, the report says, but only six states require testing on financial literacy.

The below chart, from the CEE report, “Survey of the States: Economic and Personal Finance Education in Our Nation’s Schools 2014,” offers a look at the number of states with particular policies related to financial literacy education.