College prices increased moderately in the past year, but they still outstrip the aid students get to pay the bills, leaving many young people in a financial squeeze as they try to complete their degrees, according to two new reports released Wednesday.

Researchers from the College Board, which issued the reports, found that higher education’s published charges—the “sticker price” that doesn’t include loans, grants, or tax credits—rose 2.9 percent to 3.6 percent on average between 2016-17 and 2017-18.

Those increases continue the pattern of the last five years. But they’re much smaller than the annual hikes of 6 percent to 13 percent that were common between 2000 and 2012, years that included the Great Recession.

Price increases were greater at private, four-year institutions than at public two- or four-year institutions. Here’s how they break down by sector:

That breakdown hints at another story, too: students’ difficulty paying for room and board.

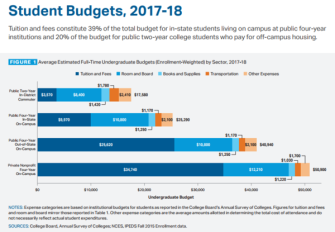

A lot of debate about the cost of college dwells on how much colleges charge for tuition and fees. But the bill for room and board is hefty, and while students might get enough aid to cover tuition and fees, they often struggle to cover room and board, according to Jennifer Ma, co-author of the reports, “Trends in Student Aid” and “Trends in College Pricing.” Those dynamics “raise particular concerns for low- and moderate-income students,” she said in a statement.

For community college students, and in-state students at public, four-year institutions, room and board eats up a bigger part of their budgets than tuition and fees, according to the College Board. While those costs are also steep for out-of-state students at public four-year institutions, and for those at private four-year institutions, they’re outstripped by the cost of tuition and fees.

The College Board reports show a continuation of a trend it’s tracked for the last five years: a decline in the federal government’s share of grant aid to students. In 2010-11, 44 percent of students’ grant aid came from federal sources, but by 2016-17 that share had declined to 32 percent. Grants given by colleges and universities, on the other hand, have increased: from 35 percent of all grant aid in 2010-11 to 47 percent in 2016-17.

Grants are playing a bigger role in student aid as federal loans have declined. The average federal loan for a fulltime undergraduate was at its highest in 2010-11, and it’s declined steadily since then. Grants, on the other hand, have risen significantly since 2010-11.

The average total aid for a fulltime undergraduate in 2016-17 was $14,400, with $8,440 coming from grants, $4,620 coming from loans, and $1,340 from education tax credits and work-study programs. In 2015-16, average total aid for a fulltime undergraduate was $14,460.